The Case for Duolingo

A Misunderstood Company in a "Falling Knife" Market.

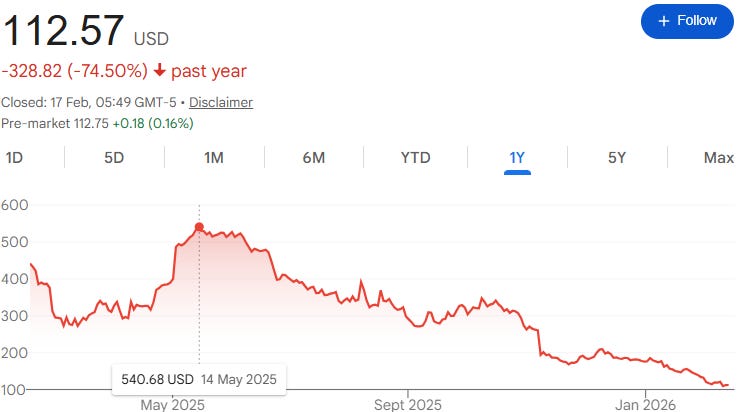

As I am currently writing this, Duolingo is trading down over 79% from its all time highs back in May 2025 less than one year ago. Year-to-date the stock is down over 36% including a 10% drop in one day when T-Mobile announced the launch of its real time AI translation service. In this article, I will go over my thesis on why Duolingo is a misunderstood stock and why it has healthy long term potential to rebound and even reach new highs.

Duolingo seems like a healthy company.

Revenue in the last five years has gone up by a staggering average of 60% per year, jumping from $70 million in 2019 up to $750 million in 2024, this year before publishing their Q4 earnings, they are already over $750 million. My guess, backed up by their estimates is that they will easily surpass a billion dollars when their earnings come out next week.

Moving on to their Daily Active Users, the company has grown from 9.5 million active users in Q1 of 2021 to over 50 million users in their most recent quarter in 2025, an annual growth rate of 45%. Their monthly active users have increased similarly from 42 million users in 2021 to 135 million users in 2025, an annual growth rate of 30%.

Likewise, paid subscribers have increased from only 1.1 million in Q1 of 2020 to 11.5 million in Q3 of 2025. In addition, the paid subscriber penetration has also risen from 5% in 2021 to 9% in 2025. Importantly, most mature apps have a paid penetration of at least 15%. Duolingo has massive potential for revenue growth using their current user base. Just to emphasize the growth of Duolingo, due to the growing user base and successfully turning more users into paid subscribers, they now have 10 times more PAID subscriptions than they used to have less than five years ago. In comparison, Spotify, the music giant has increased their paid subscriber count from 130 million to 281 million. While impressively more than doubling their subscription count, it is still nowhere close to as fast as the fast growth of Duolingo.

One more metric that is important to point out is that Duolingo is a company with a growing cash pile and zero debt. They now boast over $1.1 billion dollars in cash, meaning the company is no longer in the startup phase and is now in a position to use that cash to invest in R&D, improving their product or even acquire other companies like they did in 2025 with their acquisition of NextBeat . This allows them to swallow small start ups that contribute to their ecosystem instead of becoming potential competition, similar to what Google has done with companies such as Waze, Youtube or Android.

So if all of Duolingo’s metrics are excellent, why has the stock traded down the way it has?

The Valuation Reset:

First of all, when Duolingo’s price was at an all time high back in May 2025, it was trading at an extremely high valuation. Their P/E was over 260 and the stock was due for an adjustment even with its extremely fast growth. Part of the drop at least initially was not just another company being run over by the AI hype; rather, an excellent company that is returning to a more grounded price after being overvalued.

However, what we are seeing now is more than that, it is a mix of a valuation reset and an extremely pessimistic bear case that is driving the stock to all time lows in valuation. This massive AI scare that has hit SaaS companies has left many crippled, Duolingo is no exception.

The Bear Case:

Duolingo doesn’t actually teach a language properly, a streak does not equal a language learnt and now with AI not only will be easier than ever to learn a language, but we do not even need to learn a language as we can just use AI to live translate. Finally, Duolingo isn’t an effective app and it will be replaced by a cheaper and better AI built product. From this perspective, Duolingo is an outdated tool that will be discarded, making the stock a falling knife that will continue dropping until it eventually hits zero.

In this Bear Case, there are two main arguments that I want to challenge.

First, that due to live translation there isn’t a point in using Duolingo.

Second, the AI displacement theory. AI will be so much better at teaching languages that it will make Duolingo an ancient tool. Duolingo, having no MOAT will soon get crushed by a new company that will come out with a better and cheaper app.

The first argument is a total misunderstanding of why people use Duolingo. Duolingo is not used to be the a live translation tool. We have had Google Translate since 2006 and live translation since October 2021. Live translation is not a new feature and yet, as stated above, when T-Mobile announced that they are rolling out a live translation feature Duolingo’s stock dropped 10% as stated above. Duolingo is not used as a tool for live translation. Duolingo is used as a tool to help people learn different languages (although they have now moved into Chess, Music and Math.) and to practically speak them. People who use Duolingo want to learn the language or skill that they are learning, either due to a need for that skill or due to a desire to improve brain health, be productive, personal achievement etc. Live translation is like a calculator, Duolingo is like studying math. The stock trading off because of a live translation feature is like math teachers no longer being relevant due to the invention of a calculator.

The second argument also misses the genius of Duolingo. Duolingo may not be the “fastest” way to learn a language, but it possesses something that no one else has, a gamified version of learning languages that keeps users consistently returning to the app day after day. Duolingo sells retention more than anything. The course content is secondary to the app’s ability to bring you back day after day. In a world where all the information is at your fingertips, the barrier to learning is dedication and consistency, not resources. To give a comparison, what stops someone from running a marathon is not the knowledge, but rather the lack of hard work and consistency to come back day after day, running and sweating until you can’t feel your legs. Duolingo has perfected the retention and is getting consistently better at the content. Furthermore, while you can use Chat-GPT or Gemini to give you a lesson plan, you likely will not return day after day unprompted in order to work on your Spanish. As an English Tutor, I can confidently say that while AI is a helpful tool to build lessons for my students, it is not a substitute to the structured consistency Duolingo provides. Duolingo has recognized this and is actively incorporating more and more AI tools into their platform. However useful AI is, it lacks what Duolingo has, a notification from an owl that makes you open your phone at 11:50pm to do ten minutes of Spanish in order not to lose your 230 day streak. Another extremely important advantage that Duolingo holds over their potential competitors is the massive database that their app has. With data from billions of lessons used to refine their teaching, Duolingo possesses massive insight into the learners behavior that allows them to optimize their product around learning behavior that a generic LLM does not have access to.

The Bull Case:

Duolingo continues increasing their user base and continues to incorporate AI into their quickly expanding product. Their retention continues to be extremely strong using their tools such as streaks and a friendship system. Duolingo begins aggressively monetizing their product, driving up revenue even more and they begin converting users at a higher price point using their Duolingo Max Tier. Furthermore, Duolingo continues expanding into other learning categories such as Chess, Math and Music and in addition continues pushing Player Versus Player games that make the app more effective, addicting and enjoyable.

Duolingo does best what it wants to do best. User retention. They have perfected the app using hundreds of daily tests focused specifically on bringing the user back to the site. For example, Duolingo has a tracker to make questions easier when you make mistakes and harder when you answer correctly, similarly to how an in person tutor would lower the level after seeing his student make multiple mistakes. Their streaks bring users back daily and their interactive app makes people want to continue studying. Duolingo is the only social media where a user is likely to feel happy and productive after an hour session and not depressed after doom scrolling Instagram Reels. Next, Duolingo’s product is extremely affordable. It is the price of a single fifty minute lesson with a relatively cheap tutor on an app like Preply. Duolingo has chosen to offer a free product and an excellent low price premium tier. They have room to increase their paid users, although they have chosen to expand their user pool instead a strategy mentioned in their Q3 earnings call. Lastly, the online learning space is ever expanding and Duolingo has recently moved into Chess, Music and Math. That, along with continuing to integrate AI into their app should continue to both expand the app and improve and increase their product’s use.

Duolingo is an extremely valuable language learning tool expanding into new territory. Their financials are excellent and they will only continue to improve. AI will be a tool that helps Duolingo rather than hurts them. As of this week, Duolingo is officially in the undervalued zone, trading at a price to sales of 6.7x, less than half of its five year average. The P/E ratio is now only at 14.3. As I write this, I see that Duolingo is down another 4% today. Similar to Google, whose stock got hammered due to fears of being replaced by Chat-GPT, Duolingo will soon step out of the shade of AI fear and be seen for what it is, a learning powerhouse. It is always scary to enter a stock which is getting decimated but at some point the falling knife will hit rock bottom and begin to climb back up. Whether now or later, only the market can decide.